ISLAMABAD: The International Monetary Fund (IMF) has opposed the government’s move to raise Rs1.25 trillion from commercial banks to settle the payment of the monster circular debt in the power sector, it was reported on Saturday.

The Washington-based lender has further inquired how the Central Power Purchasing Agency (CPPA) would fund the interest and principal amount if the power demand decreases in years to come.

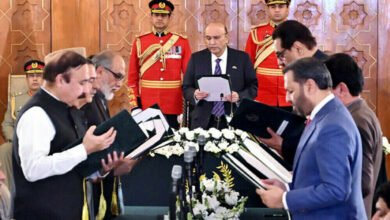

The development comes as the IMF and Islamabad re-poised to make key adjustments to the country’s macroeconomic and fiscal framework for the current fiscal year 2024-25 with the upcoming policy-level talks, scheduled to commence from Monday, will finalise these adjustments.

Meanwhile, speaking to the publication, top official sources confirmed that the IMF did not agree to any move for a reduction in the taxes, especially the General Sales Tax (GST) presented by the Power Division.

The two sides have broadly accomplished a technical round of talks and now both sides will commence policy-level talks from next week. The policy-level parleys will commence on Tuesday and are expected to conclude on Friday.

Both sides discussed the macroeconomic framework on Friday, with the possibility of revising the projection of real GDP growth and CPI-based inflation.

The government has envisaged a real GDP growth rate of 3.5% and CPI-based inflation at 12.5% for the current fiscal year.

In the wake of emerging realities on the macroeconomic front, the performance of Large Scale Manufacturing (LSM) and agriculture sectors remained below the expected levels, and now the onus mainly relies upon the services sector.

So the real GDP growth might hover around 1 to 2%. The performance of major crops is expected to be dismal and maize production will also remain lower than the desired target. Climate change has negatively impacted the performance of the agriculture sector, and livestock can only play an important role in turning its growth into a slightly positive trajectory. If it cannot perform up to the desired mark, then the agriculture growth might remain negative in the current fiscal year.

Among the major crops, cotton production witnessed a major dent. Now all eyes are focused on the yield of wheat, which might remain negative compared to last year’s bumper crop. The wheat production might remain 26.5 to 27 million tonnes. The LSM growth has turned into a negative trajectory so the services sector will remain the major driver of growth for the current fiscal year.

On CPI-based inflation, the government envisaged an inflation target at 12.5%, which had witnessed a major dip and touched 1.6% on a month-on-month basis. The CPI-based inflation is expected to hover around 6 to 6.5% for the current fiscal year.

With the possibility of revision in macroeconomic numbers, will have a major impact on the fiscal framework, so the targets on the revenues side might have to be adjusted accordingly, keeping in view new emerging realities on macroeconomic fronts.