KARACHI: The capital market staged a recovery on Wednesday, bouncing back from the previous session’s steep decline that had slashed over 1,000 points from the KSE-100 Index.

The rebound was driven by a renewed investor optimism, underpinned by robust macroeconomic signals and growing anticipation of an imminent rate cut by the State Bank of Pakistan (SBP).

The market’s rally reflected strengthened sentiment, as participants shifted focus from Tuesday’s volatility to the broader economic recovery narrative.

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Shares Index gained 1913.56 points, or 1.76%, to close at 110,810.21, after hitting an intraday high of 111,005.06 points.

“Stocks are bullish after National Savings Scheme (NSS) rates were slashed, renewing speculation over significant SBP policy easing on December 16,” said Ahsan Mehanti, Managing Director and CEO of Arif Habib Commodities.

“Robust economic indicators, rupee stability, and recovery in global equities on receding geopolitical tensions played a catalytic role in the record surge at PSX,” he added.

Key drivers include a stable rupee, government incentives for legal remittance channels, and the emigration of over one million skilled workers in the past three years. Reforms targeting illicit foreign exchange trading and easing global inflation have also supported growth.

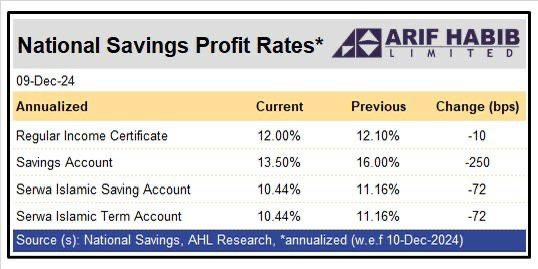

Arif Habib Ltd reported on Monday that the government has revised profit rates on National Savings Schemes (NSS) effective December 10. The most significant cut was made to the Savings Account rate, which fell by 250 basis points to 13.5% from 16%.

The Regular Income Certificate profit was reduced slightly by 10 basis points to 12.1%, while the returns on Serwa Islamic Savings Account and Serwa Islamic Term Account were cut by 72 basis points to 10.44%.

These adjustments are expected to channel funds away from savings instruments and into equities, bolstering market activity. Analysts see the NSS rate revision as a signal of further monetary easing by the State SBP.

Remittance inflows reached $14.8 billion during the first five months of FY2025, marking a 33.6% year-on-year increase, according to the SBP. November inflows alone totaled $2.9 billion, up 29.1% compared to the same period last year, though slightly lower than October’s figure.

Macroeconomic improvements continue to underpin positive market sentiment. Inflation dropped to 4.9% in November, its lowest level since April 2018, paving the way for monetary easing. Analysts widely expect the SBP’s Monetary Policy Committee to cut interest rates by 200 basis points during its December 16 meeting, following a cumulative 700bps reduction since June.

Foreign reserves received a boost from Saudi Arabia’s extension of a $3 billion deposit for another year and trade agreements worth $560 million. Petroleum sales surged to a 25-month high of 1.58 million tons in November, while the government’s Rs353 billion Ijarah Sukuk auction provided additional liquidity.