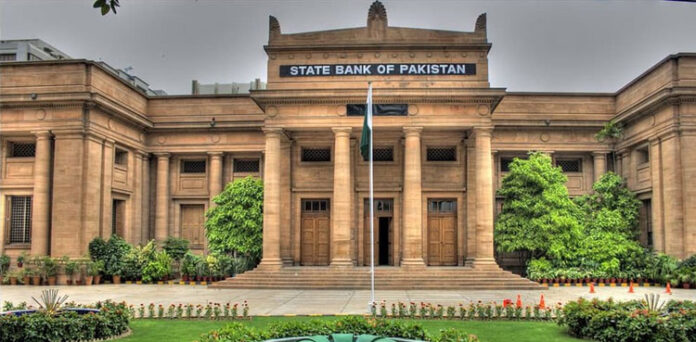

KARACHI: The State Bank of Pakistan has launched a new version of the Electronic Credit Information Bureau (eCIB) system V2 in Karachi.

According to reports, the new eCIB system, will be operational from January 1, 2025. The newly introduced V2 aligns with technological advancements and reporting standards.

It introduces several updates and amendments to credit information reports.

What is eCIB?

The Credit Information Bureau (CIB) of the State Bank of Pakistan, established in 1992 under Section 25(A) of the Banking Companies Ordinance-1962, plays a crucial role in credit risk management and promoting a sound credit culture within the financial system.

Initially, CIB’s activities were focused on collecting and organizing data of borrowers with loans of Rs. 500,000 and above on a quarterly basis. However, the system evolved significantly with the introduction of eCIB online facilities in 2003, making CIB the first in the region to offer such services.

The revamped eCIB, operational since September 2005, now incorporates a wider scope by removing the minimum reporting threshold, capturing data from more than 4 million borrowers across about 100 member institutions.

This new system uses advanced technology, including high-capacity servers, security measures, and point-to-point encryption, improving efficiency, speed, and reliability. The enhancements enable financial institutions to make informed lending decisions, assess credit risks more accurately, and expand access to credit across diverse borrower categories like SMEs, agriculture, and consumer finance sectors.

The strengthened CIB contributes to the financial stability and promotes international standards in Pakistan’s financial system.

Earlier, State Bank of Pakistan stated that country’s current account balance remained in surplus for the fourth consecutive month.

The State Bank of Pakistan reported a current account surplus of $729 million for November 2024, marking the highest surplus since February 2015. The surplus reflected a positive trend in the country’s economic indicators, showing an improvement in the balance of payments.

In addition to this, the trade, services, and income deficit for November amounted to $2.35 billion. For the first five months of the fiscal year, the current account surplus reached $944 million, highlighting a significant turnaround compared to previous periods.

As per the State Bank of Pakistan, from July to November, Pakistan’s exports totaled $13.28 billion, while imports were $22.97 billion, resulting in a trade deficit of $9.68 billion. This deficit is a 10pc increase compared to the same period last year. To manage the trade gap, the country has additional resources available, amounting to a 33pc increase compared to previous years.

Remittances from workers also contributed positively, with $14.76 billion received in the first five months of the fiscal year, State Bank stated.

Despite a slight decrease in IT exports in November, which stood at $324 million marking a 2pc drop compared to October, the overall economic outlook remains optimistic with a surplus of $729 million recorded for the month.