The stock market surged to an all-time high on Wednesday, continuing its bullish momentum as investor confidence remained strong.

The market gained traction following optimism surrounding progress in resolving circular debt issues.

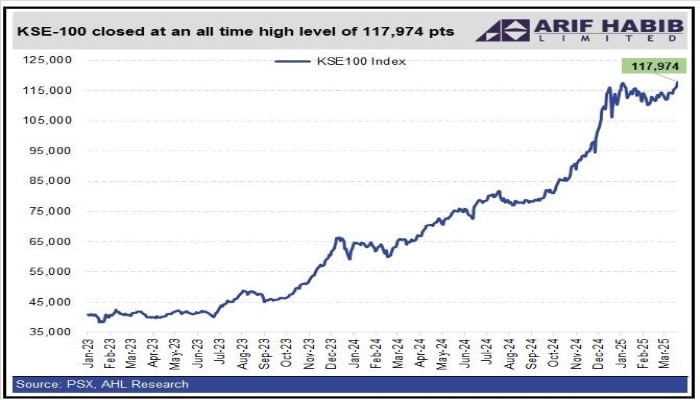

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index surged by 972.93 points, or 0.83%, to close at 117,974.02, up from the previous session’s 117,001.09. The index hit an intraday high of 118,243.63, while the session’s lowest point was recorded at 116,882.80.

According to Arif Habib Limited, this was the all-time high level at close of session for the KSE-100 Index, a milestone that reflects the market’s resilience amid broader economic recovery efforts.

The rally was largely driven by optimism surrounding the potential resolution of circular debt and a cash infusion into the energy sector, which has been a key concern for the economy.

“Potential resolution of circular debt and cash infusion into the energy chain are driving today’s market gains,” said Samiullah Tariq, Head of Research at Pak-Kuwait Investment Company.

In the energy sector, Pakistan’s furnace oil exports reached a record 933,000 tonnes in the first eight months of the current financial year, as the country continues phasing out its use due to high costs and environmental concerns.

However, fuel oil exports declined to 39,000 tonnes in February, down from 190,000 tonnes in January. Industry sources attributed the drop to an accumulation of furnace oil in local refineries, as buyers prefer bulk purchases.

Power generation data for the July-February 2024 period revealed that furnace oil now plays a minimal role in Pakistan’s energy mix. The government’s new refining policy aims to cut high-sulphur furnace oil production by 78%, reducing daily output from 15,500 metric tonnes to 3,400 metric tonnes once planned upgrades are completed.

Meanwhile, Pakistan’s information technology (IT) exports maintained their upward trajectory, recording $305 million in February, reflecting a 19% year-on-year (YoY) increase. However, exports declined by 3.0% on a month-on-month (MoM) basis. This marks the 17th consecutive month of YoY growth in IT exports, which reached $2.48 billion in the first eight months of FY25, up 26% from the previous year.

Analysts at Topline Securities attributed the YoY increase in IT exports to several factors, including an expanding global client base for Pakistani firms, particularly in the Gulf Cooperation Council (GCC) region.

Additional factors included the State Bank of Pakistan’s (SBP) policy changes allowing IT firms to retain a higher portion of their foreign currency earnings and increasing stability in the rupee, which encouraged exporters to bring a larger share of their profits back to Pakistan.

Investors responded positively to reports that the IMF approved Pakistan’s request to borrow Rs1.25 trillion ($4.5 billion) from domestic banks to help reduce its mounting circular debt without adding to the official public debt stock.

This agreement, finalised during policy discussions between Pakistani authorities and the IMF, provides much-needed fiscal breathing room while addressing inefficiencies in the power sector.